Navigating the unpredictable realm of travel can be daunting, with over 50% of explorers encountering disruptions like lost baggage or health crises. This unpredictable nature underscores the significance of comprehending how travel insurance works. As a fervent traveler, I’ve recognized that having a safety net can be invaluable. At Mihitravel, we’ll unravel the intricacies of travel insurance, highlighting its pivotal roles, the diverse coverages it offers, and its inherent benefits. It’s not just about choosing a policy; it’s about understanding its exclusions and making informed decisions. Equip yourself with this knowledge and embark on your journeys with enhanced peace of mind.

Types of Travel Insurance Coverage

If you’re planning on doing any adventurous activities during your trip, like bungee jumping or skydiving, it’s important to make sure your travel insurance covers these high-risk activities. Not all travel insurance policies provide coverage for adventure sports, so it’s crucial to check the details before purchasing a plan.

One aspect to consider is pre-existing medical conditions. Some policies may exclude coverage for any injuries or illnesses related to a pre-existing condition. Therefore, if you have any such conditions, it is important to disclose them when applying for travel insurance.

Adventure sports often involve higher risks and potential injuries compared to regular activities. Therefore, having appropriate coverage in place can give you peace of mind while engaging in these thrilling experiences. Your policy should cover emergency medical expenses resulting from accidents during adventure sports.

When selecting a travel insurance policy that includes adventure sports coverage, be sure to read the fine print and understand what specific activities are covered. Look for policies that explicitly mention the types of adventure sports they cover and ensure they align with your planned activities.

- Comprehensive Travel Insurance: This type of policy usually covers a wide range of situations including trip cancellation, medical emergencies, baggage delays, and more. It’s a comprehensive package that ensures travelers are covered for various unforeseen circumstances.

- Medical Only Coverage: Specifically designed to cover medical emergencies while traveling, this insurance is vital for travelers heading to destinations where medical treatment can be costly or regions with potential health risks.

- Trip Cancellation or Interruption Coverage: If unexpected events force you to cancel or cut short your trip, this coverage ensures you aren’t left out of pocket for pre-paid expenses.

- Baggage Loss or Delay Coverage: This ensures you’re compensated if your luggage is lost, delayed, or damaged during your journey.

- Evacuation Insurance: In extreme circumstances, such as serious illness or political unrest, this policy covers the costs of transporting you to a safer location or back to your home country.

How to Choose the Right Travel Insurance Policy

- Duration of Your Trip: Consider the length of your trip. For extended journeys, ensure that your insurance can cover the entire duration and is extendable if necessary.

- Destination-Specific Issues: Some areas might have specific health risks or higher chances of natural disasters, so your coverage should be relevant to your destination.

- Special Activities: If you’re planning to participate in activities such as skiing, diving, or trekking, ensure they’re covered.

- Cancellation Cover: Make sure you understand under what circumstances you can claim a trip cancellation.

- Ease of Contact: In case of emergencies, you’ll want an insurer that’s easy to contact, preferably with a 24/7 helpline.

Comparing policies side by side can help you determine which one offers the best value for money while meeting all your requirements. Pay attention to coverage limits, exclusions, and any additional benefits that may be included.

Understanding the Claims Process

To optimize the claims experience, it’s essential to be aware of the entire process from the onset. Once an insured event occurs, such as a medical emergency or a trip disruption, the first step involves collecting and organizing all pertinent documents. This might encompass receipts, medical certificates, or official statements, depending on the incident.

During the claim submission phase, you’ll usually fill out a designated form and attach the gathered evidence. Subsequently, your insurer undertakes the task of examining the claim, gauging its legitimacy, and ensuring it aligns with the policy’s terms. It’s crucial to recognize that claims can sometimes be declined due to reasons like non-disclosure of certain health conditions or claims stemming from irresponsible activities.

Following a successful claim assessment, the insurer reimburses the agreed-upon amount as per your policy’s conditions. Conversely, if the claim faces rejection, your policy might provide a pathway to contest the decision or seek an alternative resolution mechanism. Grasping these stages can significantly streamline any future claims you might have to lodge. Now, delving deeper into the myriad benefits of travel insurance

Benefits of Travel Insurance

The allure of travel insurance lies in its ability to act as a safety net, cushioning travelers from the unforeseen twists that journeys often entail. At the heart of its appeal is the medical protection it extends, ensuring that ailments or accidents in unfamiliar terrains don’t escalate into financial burdens. Especially when venturing into regions known for exorbitant healthcare fees, this coverage becomes indispensable.

Yet, the advantages of travel insurance don’t halt at healthcare. Imagine meticulously planning a trip only for a sudden illness or an unpredictable calamity to thwart your plans; this is where trip cancellation or interruption safeguards step in, offering a financial reprieve for any non-refundable commitments. Similarly, should you find yourself standing at a carousel with no suitcase in sight, baggage provisions will compensate for the loss, aiding in swiftly restoring any essentials.

Beyond these tangible benefits lies an intangible one that’s equally pivotal: the 24/7 emergency assistance. Whether it’s guidance in navigating a medical crisis, liaising with local authorities, or orchestrating an unplanned return, this around-the-clock support can be a lifeline in moments of disarray. As you weigh the merits of travel insurance, it’s prudent to also discern its contours, recognizing any exclusions or conditions that might apply.

Exclusions and Limitations

While travel insurance serves as a protective umbrella for travelers, it’s essential to be aware of the patches where the rain can seep through. A significant gray area is the realm of pre-existing conditions. Many policies might not extend their coverage to health issues that existed prior to the insurance’s commencement. This means if an old ailment flares up during a trip, the medical costs might have to be borne out of pocket.

Adventure enthusiasts, too, need to tread with caution. The adrenaline rush of extreme sports or off-the-beaten-path adventures is incomparable, but such high-risk endeavors might find themselves outside the ambit of a standard policy. Without a specific add-on, an unfortunate incident during a bungee jump or mountain climbing could leave you with more than just memories.

Furthermore, geopolitics and safety concerns can also shape the coverage landscape. Embarking on journeys to territories flagged with travel advisories might not just be a risk in real-time but can also lead to insurance coverage being voided. It underscores the importance of diligently reviewing policies and ensuring that every step of your voyage remains under the protective aegis of your chosen insurance.

Pre-existing Conditions

The very essence of travel is to break free from our daily constraints, but when it comes to pre-existing conditions, there’s a web of complexities in the travel insurance domain that needs to be navigated with precision.

The realm of pre-existing conditions is multifaceted, encompassing everything from a long-standing heart ailment to a knee surgery done a couple of months prior to the journey. Such conditions often raise red flags for insurance providers due to the potential higher risk of claims. While some policies might seem accommodating at a glance, the devil often lies in the details. Coverage for these conditions can be beset with caveats, sometimes in the form of waiting periods or higher premiums.

Given these intricacies, it’s paramount for travelers to not just declare their medical history transparently but to also dissect the clauses related to their conditions. A meticulous review, coupled with open conversations with the insurance provider, can make the difference between a trip that’s carefree and one overshadowed by unforeseen medical expenses. As we set the compass towards understanding the landscape of travel insurance further, let’s delve into the thrills and spills of high-risk activities.

High-risk Activities

The thrill of adrenaline-pumping activities is an alluring part of many vacations. From diving deep into the abyss to soaring high above the clouds, these adventures, although exhilarating, come with their share of risks.

High-risk activities, like paragliding, mountain climbing, or white-water rafting, inject a sense of adventure into our trips, but they also demand extra vigilance in the insurance department. While these escapades promise memories that last a lifetime, they can also lead to unforeseen accidents. And here’s where the tricky part lies: standard travel insurance policies often sidestep these activities, categorizing them under exclusions. This means that any mishap during these pursuits might leave you without financial coverage. However, the evolving travel insurance landscape recognizes the adventurer’s spirit. Thus, bespoke policies or premium add-ons catering specifically to adrenaline-junkies have emerged.

For those with a penchant for pushing boundaries, it’s not just about finding the next thrill but ensuring that their leap of faith, quite literally sometimes, is backed by a safety net. As we pivot from the highs of adventure, let’s tread into territories marked by uncertainties: countries or regions with travel advisories.

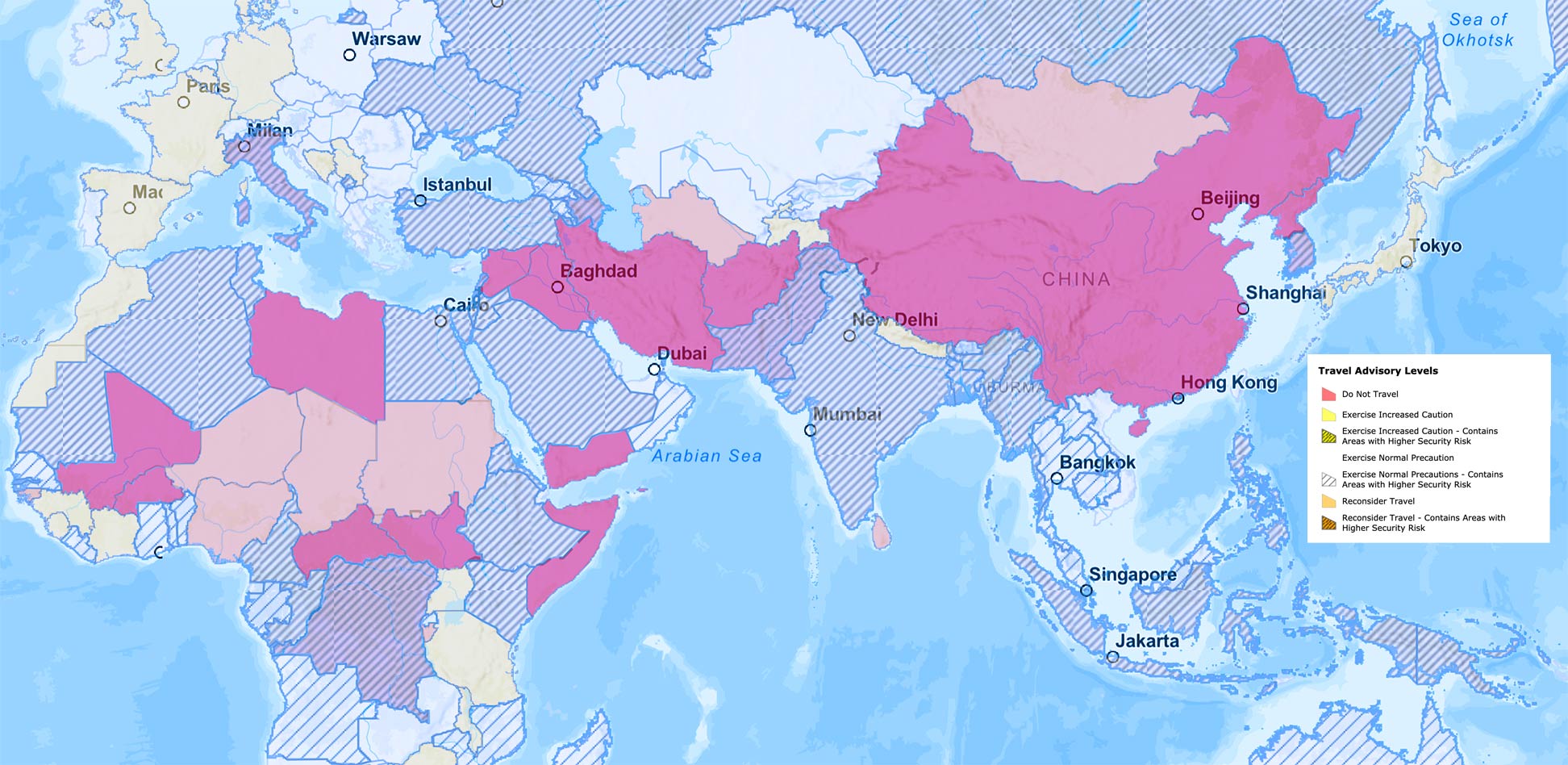

Countries or Regions with Travel Advisories

Embarking on a journey to regions with travel advisories requires a blend of adventure and prudence. While the lure of the unexplored can be compelling, these warnings serve as a compass, guiding travelers away from potential dangers.

Governments don’t issue these advisories lightly; they are based on a cocktail of factors, ranging from on-ground intelligence to historical precedents. Sometimes these alerts are temporal, linked to upcoming events or recent disturbances, while at other times they might point to more chronic issues of a particular region. The underlying thread is always the safety and well-being of the traveler. Ignoring these advisories can also have implications on your travel insurance. Many insurance policies have explicit clauses that exclude coverage for regions under travel advisories. This means that if you choose to venture into these areas, you might be doing so without the safety net of insurance.

To embrace the world with open arms, yet with eyes wide open, is the traveler’s mantra. Paying heed to travel advisories equips you with the knowledge to tread unknown terrains safely. As we delve deeper into the intricacies of travel insurance, let’s turn our attention to other facets that shape our travel decisions.

Additional Tips for Travel Insurance

Travelling is a thrilling experience, but it also comes with its share of uncertainties. Being prepared is paramount, and travel insurance plays a crucial role in this preparation. Here are some vital tips to consider.

Purchase Insurance Early

To get the most out of your travel insurance, it’s crucial to purchase it early and not wait until the last minute. The timing of your purchase plays a significant role in the coverage options available to you. By purchasing travel insurance early, you give yourself ample time to research and compare different plans, ensuring that you find one that meets your specific needs.

Additionally, buying insurance early provides you with a longer period of coverage before your trip even begins. This means that if any unforeseen circumstances arise before you leave, such as illness or injury, you may be eligible for cancellation or trip interruption benefits. By securing your travel insurance well in advance, you can have peace of mind knowing that you are protected from any unexpected events along the way.

Keep Copies of Important Documents

Before embarking on your journey, make sure you have copies of all your important documents and hold onto them tightly throughout your travels. This includes your passport, driver’s license, travel itinerary, and any other identification or travel-related papers. These copies can be invaluable in case your originals are lost or stolen while you’re away.

In addition to keeping copies of important documents, it is crucial to understand the coverage provided by your travel insurance policy. Familiarize yourself with the terms and conditions, including what is covered and any exclusions or limitations. This will help you make informed decisions during your trip.

Understanding policy renewal and extension options is the next step in ensuring continuous coverage for your travels. It is important to know how long your policy lasts and if it can be extended if needed. Be aware of any time limits or restrictions that may apply when renewing or extending your policy.

Now let’s move on to understanding policy renewal and extension options…

Understand Policy Renewal and Extension Options

When purchasing travel insurance, it’s important to understand the policy renewal and extension options available. Policies typically have a specific duration, ranging from a few days to several months. Exceeding this timeframe may result in policy cancellation and loss of coverage. If you need coverage beyond the initial duration, some policies offer renewal or extension options. However, there may be limitations on renewals or extensions, such as maximum coverage limits or restrictions based on age or pre-existing conditions. Understanding these details will help you plan accordingly and ensure continuous protection throughout your travels.

Moving on to frequently asked questions about travel insurance…

FAQs about Travel Insurance

Curious about travel insurance? Find answers to your burning FAQs right here!

One common question is how much does travel insurance cost? The cost of travel insurance varies depending on various factors such as the length of your trip, your age, and the level of coverage you choose. Generally, travel insurance can range from 4% to 10% of the total trip cost. It’s important to compare different plans and providers to find one that suits your needs and budget.

Another frequently asked question is about travel insurance coverage limits. Coverage limits refer to the maximum amount an insurer will pay for a specific benefit or claim. These limits can vary for different types of coverage, such as medical expenses, trip cancellation/interruption, baggage loss/delay, and emergency evacuation. It’s crucial to understand these limits before purchasing a policy so that you have a clear idea of what is covered and up to what amount.

When considering travel insurance, it’s essential to read the policy terms and conditions carefully. Make sure you fully understand what is included in your coverage and any exclusions or limitations that may apply. If you have any doubts or questions, reach out to the insurer or agent for clarification.

Remember that travel insurance provides peace of mind by protecting you financially against unexpected events during your trip. By understanding its cost and coverage limits, you can make an informed decision when choosing a suitable plan for your travels.

Frequently Asked Questions

Is travel insurance necessary if I already have health insurance?

No, travel insurance is not necessary if you already have health insurance. However, travel insurance offers additional benefits such as trip cancellation coverage, lost baggage protection, and emergency medical evacuation that your health insurance may not cover.

Can I purchase travel insurance after I have already started my trip?

Yes, you can purchase travel insurance after you have already started your trip. It is important to note that the coverage may vary depending on the policy and provider, so it’s essential to thoroughly review the terms and conditions before making a purchase.

What happens if my travel insurance policy expires while I am still on my trip?

If my travel insurance policy expires while I’m still on my trip, I won’t be able to make any new claims. It’s important to ensure that your policy covers the entire duration of your trip to avoid any complications.

Will travel insurance cover the cost of cancelling my trip due to a natural disaster?

Travel insurance typically covers trip cancellation due to natural disasters, but it’s important to read the policy details. It may also provide coverage for medical treatment costs and reimbursement for lost or stolen luggage.

Can I make multiple claims on my travel insurance policy for different incidents that occur during my trip?

Yes, you can make multiple claims on your travel insurance policy for different incidents that occur during your trip. However, it’s important to note that there are coverage limits for each claim, so be aware of those when filing.

Maybe you need:

- How to Plan a trip in 7 Easy Steps

- How to Make Money While Traveling: 16 Creative and Best Travel Jobs for Earning on the Go

Travel insurance is a crucial investment for planning trips, providing peace of mind and protection against unexpected events. Choose the right policy and understand the claims process for emergencies. Despite potential exclusions and limitations, the benefits outweigh any drawbacks.